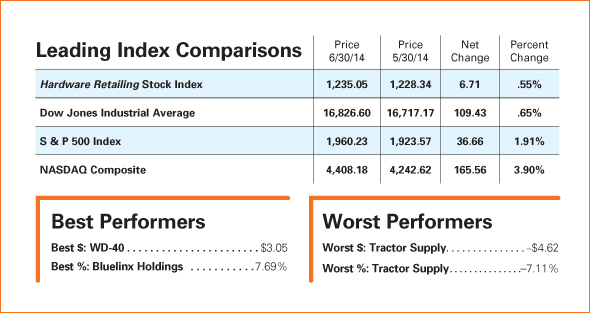

The Hardware Retailing Stock Index posted another positive close in June, buoyed by an improving housing market and gradually strengthening economic conditions. The index rose 6.71 points, or 0.55 percent, and closed at 1235.05. Advancing issues easily topped declining issues at a 13-to-4 count.

The Commerce Department said that sales of new homes shot up 18.6 percent in May, following a 3.7 percent increase in April. The U.S. posted the fourth consecutive month of job gains, with 217,000 jobs added in May. Job growth boosted consumer confidence slightly, with the University of Michigan index coming in at 82.5 for June, compared to 81.9 in May, but still substantially below the April reading of 84.1, the highest in a year. The Commerce Department reported that U.S. retail sales rose 0.3 percent in May, the fourth consecutive month of improvement; economists were expecting a rise of 0.4 percent.

Economic data continued its upward trend, but tensions in Iraq leaned on markets this month. The Dow industrials and the S&P 500 shot to new records to begin the month; when our session ended June 30, 2014, the S&P 500 and the Nasdaq posted the sixth straight quarter of gains. Even so, Wall Street was pressured by a forecast from the World Bank which anticipated slightly slower growth for the global economy this year; the bank cut its estimates of increase from 3.2 percent to 2.8 percent. The Commerce Department said that consumer spending in May was less than expected, only up 0.2 percent after no improvement in April. Orders for durable goods fell 1 percent in May, driven by a steep drop in military equipment.

The Conference Board’s gauge of leading economic indicators, a measure of future health, improved for the fourth month in May, up 0.5 percent, up from a revised 0.3 percent gain in April, a trend that was broadly positive across all sectors. Factory production rose 0.6 percent in May in a broad swath that touched all sectors. “I’m not seeing anything that’s going to derail the overall upward climb of the market,” said Karyn Cavanaugh, senior market strategist with Voya Investment Management. “The economic backdrop is getting better, so companies will make even more money.”

WD-40 announced a regular quarterly dividend. The company’s third fiscal quarter dividend of $0.34 per share will be payable to shareholders of record as of July 11, 2014. WDFC will post its third fiscal quarter results after market close on July 9, 2014. WD-40 rose 3.05 points, or 4.23 percent, and was the top dollar gainer. WDFC closed at 75.22.

Tractor Supply slipped 4.62 points, or 7.11 percent and closed at 60.40. Research firm Morgan Stanley initiated coverage on TSCO with a rating of “equal weight.” Their price target on Tractor Supply is $70. TSCO was the top dollar loser.

Sherwin-Williams rose 2.30 points, or 1.12 percent. Analysts at Susquehanna International Group upped their price target to $232, from $170. Their current rating on SHW is “neutral.” Sherwin-Williams closed at 206.91.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information