Click the picture to download a PDF of this story.

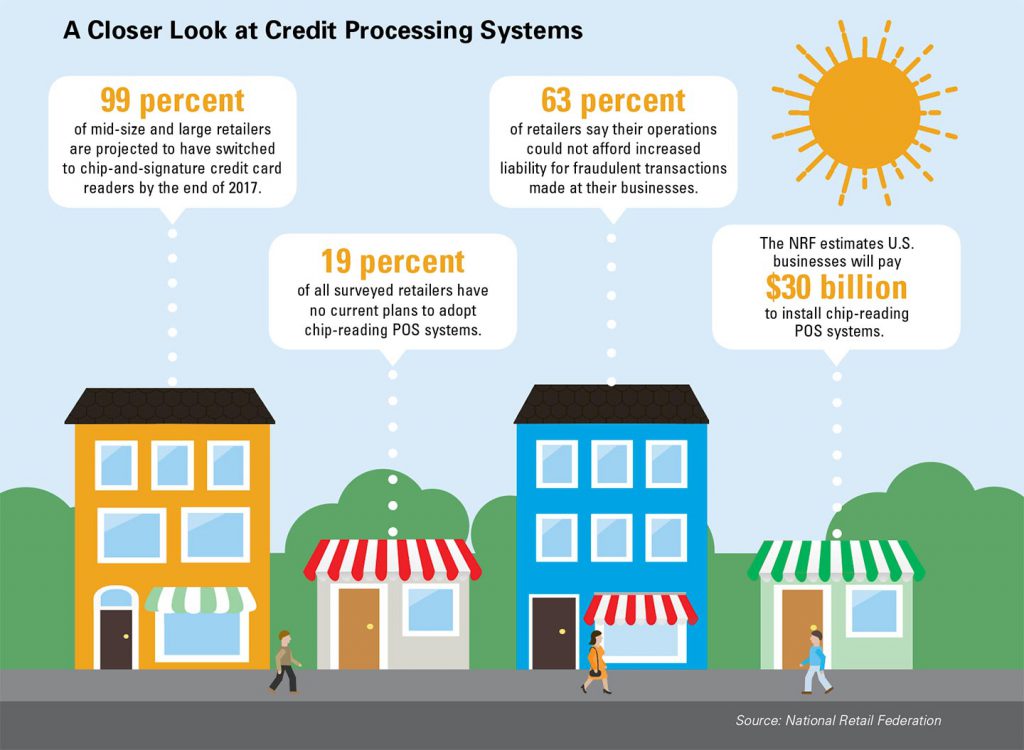

A new study from The National Retail Federation (NRF) finds that small business owners across the country are adopting new chip-and-signature credit card readers, but many still want increased credit card security.

According to the study, 49 percent of U.S. retailers say their operations would be more secure if credit cards used a personal PIN like other countries use. Chip-and-PIN credit cards require a special code to ensure only authorized holders are making purchases.

Before October 2015, banks shouldered the costs of purchases made with counterfeit credit cards at their stores. Now, retailers must pay for fraudulent purchases made on a credit card with a chip if their stores do not have a chip-reading POS system.

Applied to Retail

No matter what kind of credit card reader your operation uses, ensure that your staff is following protocol for credit card payments. Teach them to analyze signatures on receipts and on the backs of credit cards and report suspected credit card fraud to authorities immediately.

According to USA Today, 78 percent of consumers have positive feelings regarding chip credit cards. Reminding your customers that you value their privacy and financial security can help them feel secure making purchases at your operation.

Each chip reader costs about $2,000 to install, which could be a small investment that helps your operation avoid potential liability on fraudulent purchases.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information