Lowe’s is making a comeback before it needs one. The company has been busy since 2018, restructuring its executive team, shedding side ventures and reevaluating its approach to serving professional customers. The retailer is refocusing on growing its core U.S. operations, igniting an internal revamp to improve an already solid business.

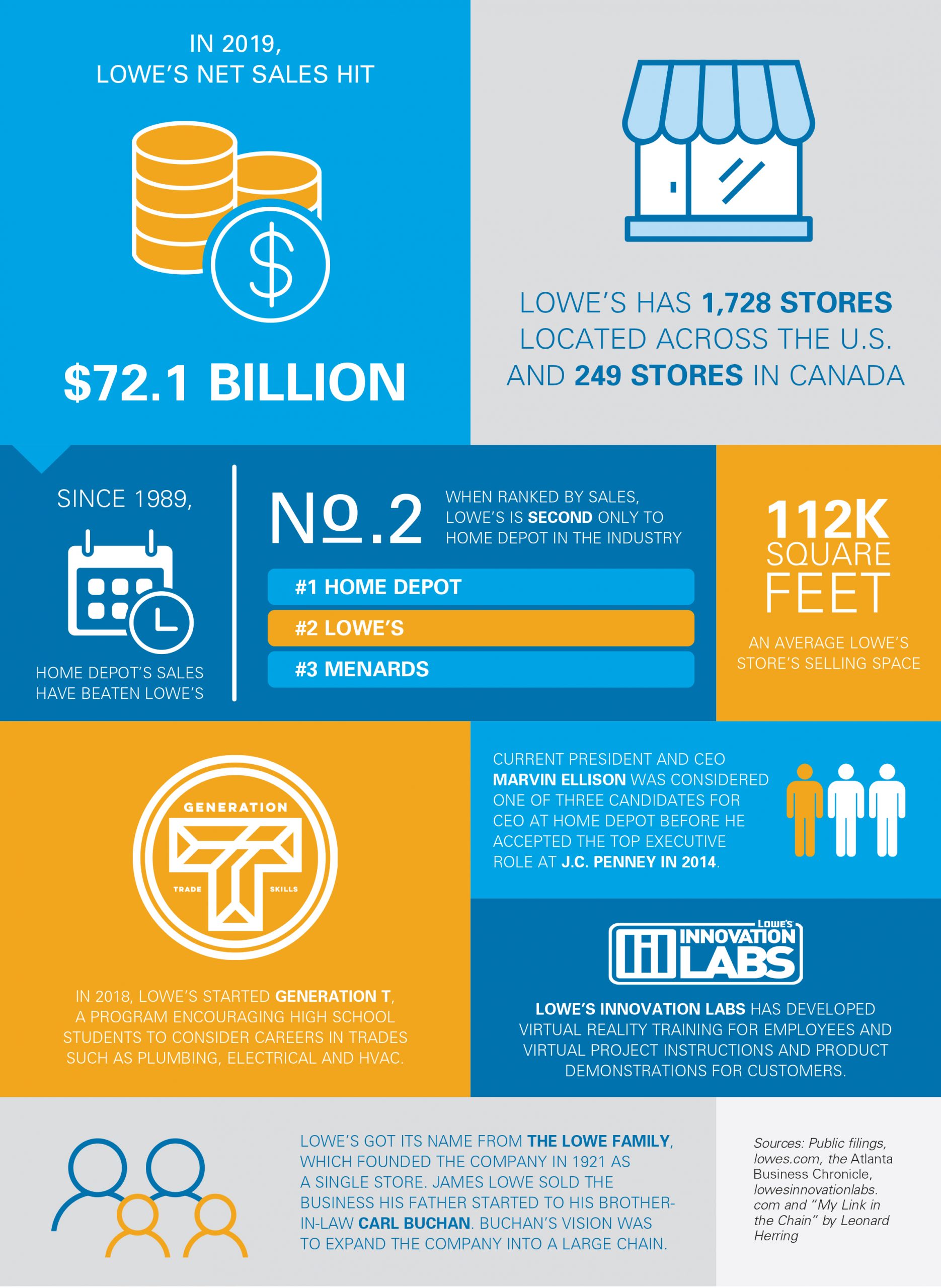

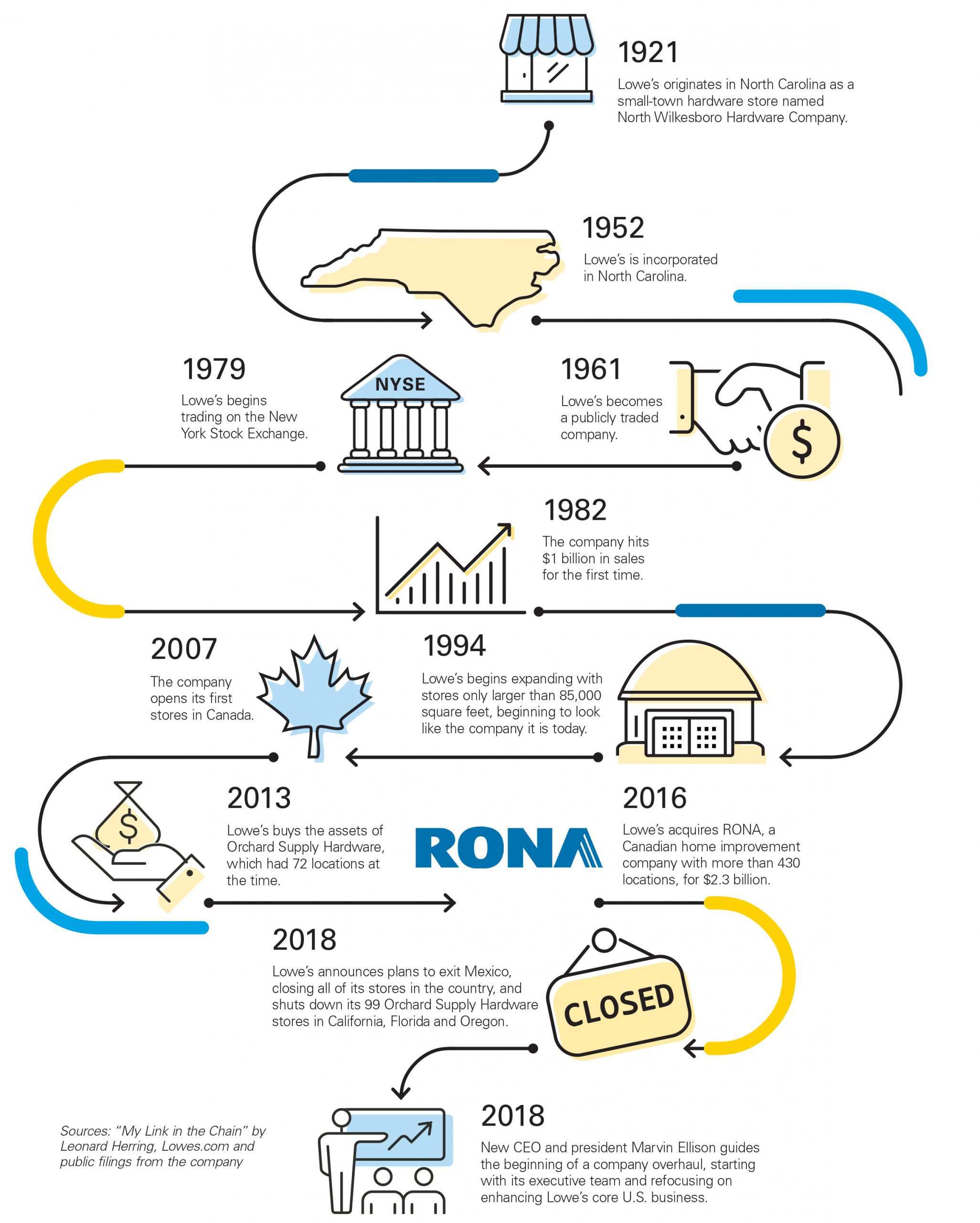

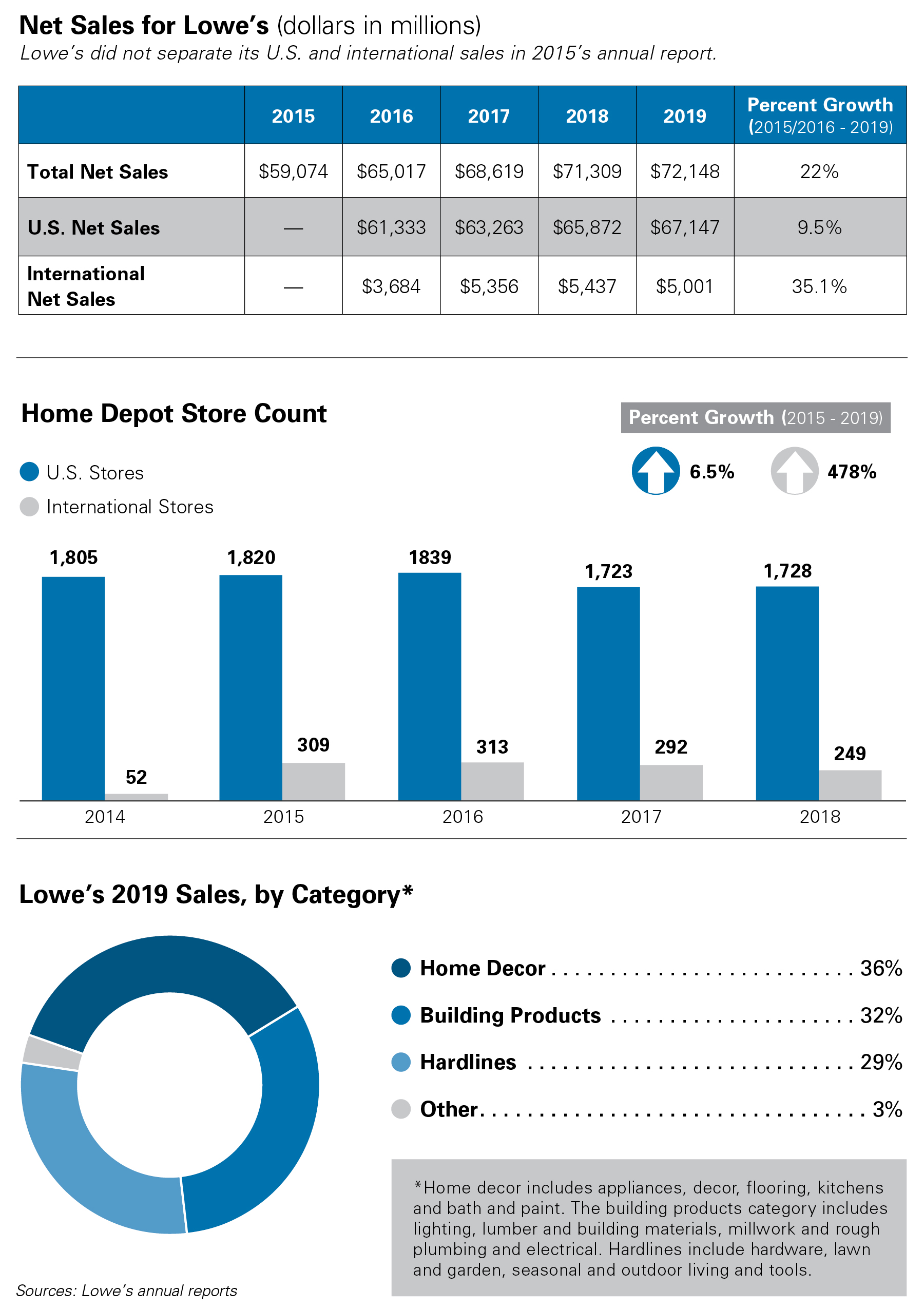

Lowe’s has cemented its place as the second-largest home improvement retail operation in the U.S., trailing Home Depot in net sales since 1989.

Both Lowe’s and Home Depot grew their store counts and sales rapidly in the 1990s and early 2000s, dabbled in acquiring subsidiary businesses, tested overseas markets and weathered the economic downturn in 2008. Neither company faltered long during and after the Great Recession; they both slowed their growth and saw sales dip, then bounced back.

Now, Lowe’s leadership has set out to gain market share by improving what the company is good at while upgrading the way it serves professional customers and refreshing its e-commerce presence.

Read on for a glimpse of Lowe’s history, recent initiatives and insight into its strengths and weaknesses.

Lowe’s: Past and Present

Lowe’s is a resilient company.

The home improvement retailer began as a single hardware store in 1921,1 which was shortly after the end of World War I.

Its founder, Lucius Lowe, opened North Wilkesboro Hardware Co. in North Carolina.2 He kept the operation going through the Great Depression and until his death. Eventually, his son James Lowe took ownership and became business partners with his brother-in-law Carl Buchan.1,3

Buchan imagined Lowe’s as a chain of hardware stores and ambitiously expanded the operation, taking advantage of a post-World War II housing boom.3

For decades, Lowe’s customers were primarily professional contractors who were working to keep up with high demand for new home construction.

Buchan bought out James Lowe in 1952 and led the company’s growth to 15 stores, but died suddenly in 1960 at age 44,3,4 ushering in a time of uncertainty for the business. Buchan’s executive team had been involved in conversations about converting the company into an employee-owned operation, but Buchan was still owner when he died and the leadership team’s primary priority after his death was to keep the business afloat.3 Leonard Herring, who oversaw finances for the company at the time, describes the period following Buchan’s death as the “most hectic 12 months of my life.”5 Herring and a team of four other executives worked with Buchan’s widow, the executors of Buchan’s estate and outside investors to find a way for the team to continue operating the business instead of watching it fail or selling it.5 To finance buying out Buchan’s stock, they took the company public in 1961.3 They overcame the challenges of Buchan’s death and led Lowe’s to further growth. Herring became president and CEO in 1978,6 overseeing Lowe’s transition to large big-box stores in the 1980s and a new focus on DIYers. Before Herring retired in 1996, the company grew to 365 locations and was expanding only through large-format stores.8

Lowe’s 1995 annual report says, “Since 1989, the Company has been implementing a store expansion strategy to transform the Company from a chain of small stores into a chain of destination home improvement superstores.”7

The early 2000s continued as a time of growth for the company, with the economic downturn of 2008 barely slowing Lowe’s momentum.

From 2000 to 2005, the company more than doubled its sales, growing from nearly $19 billion in net sales to about $43 billion.9 The company surpassed 1,000 locations in 2005.9 Sales hit a high of $48.3 billion in 2007, dipped only 2 percent in 2009 and beat pre-recession numbers again in 2010.9

“Since 1989, the Company has been implementing a store expansion strategy to transform the Company from a chain of small stores into a chain of destination home improvement superstores.” —Lowe’s 1995 annual report

At the same time, the retailer continued opening stores and dabbling in new ventures, despite the slowdown in construction and high unemployment. It entered the Canadian market in 2007 and opened stores in Mexico in 2009.10

Between 2011 and 2016, the company started and ended a partnership with an Australian home improvement company.9

Lowe’s also expanded through acquisitions, such as the 72-store Orchard Supply Hardware chain in 2013.9 In 2016, the company bought RONA, a Canadian home improvement company with more than 430 locations, for $2.3 billion.11

The company also launched new technology projects, such as store robots and virtual reality experiences for employee training, through its technology program, Lowe’s Innovation Labs.12

Lowe’s direction shifted somewhat with a leadership change in 2018. Robert Niblock, CEO and chairman of 13 years,13 retired and the company replaced him with former Home Depot executive Marvin Ellison.10

Ellison had worked for 12 years at Home Depot, leaving an executive vice president role after a CEO change and going to J.C. Penney. He spent about four years working on a turnaround for the struggling department store chain14 before taking the top executive position at Lowe’s.

Under Ellison, Lowe’s has reframed its growth plans. In less than two years, the company has restructured its executive leadership team, aiming for simplified roles.

It has also closed underperforming stores, exited the Mexican market, shut down all 99 Orchard Supply Hardware locations and begun energetic plans to regrow its professional customer base.9

The goal: A strategic refocus on improving and growing Lowe’s U.S. home improvement operation.

“Our top priority in the third quarter was positioning Lowe’s for long-term success by identifying underperforming or non-core businesses and stores for divestiture,” Ellison says in a 2018 statement. “With our strategic reassessment substantially completed, we can now intensify our focus on the core retail business.”10

1Business Insider, Aug. 19, 2019

2Business North Carolina, June 6, 2017

3Business North Carolina, Oct. 27, 2011

4Wilkes Journal-Patriot, Nov. 21, 2016

5“My Link in the Chain” by Leonard Herring

6Wilkes Journal-Patriot, Dec. 2, 2016

7Lowe’s 1995 annual report

8Careers.lowes.com

9Multiple Lowe’s annual reports

10Lowes.com

11The New York Times, Feb. 3, 2016

12Lowesinnovationlabs.com

13CNBC, March 26, 2018

14The Wall Street Journal, May 22, 2018

A SWOT Analysis of Lowe’s

To read more about Lowe’s strengths, weaknesses, opportunities and threats, click on the icons below.

Strengths

Size. Being large gives Lowe's the benefits of economies of scale, massive buying and price negotiating power, long-standing relationships with manufacturers, 1,977 store locations in the U.S. and Canada, a strong supply chain and significant brand recognition.

Alliances. Partnerships strengthen Lowe's position in the minds of consumers and professional customers.These include collaborations with the NFL and property and asset management software company Yardi, as well as with other large corporations through Lowe's Generation T trades program.

Price Image. The company has a reputation for offering low prices in the home improvement industry, benefiting from the big-box image of being inexpensive even when its prices aren't lower than competitors.

New Leadership. A group of new, but highly experienced, top executives, led by CEO and president Marvin Ellison, is reevaluating company initiatives and has the motivation and momentum to bring extensive improvements.

Steady Sales Growth. Lowe's stores have seen consistent year-over-year sales growth for at least three decades, with only slight dips in 2008 and 2009 due to the economic downturn in 2008. Sales surpassed pre-recession levels in 2010 and have been on an upward trajectory ever since.

Wide Product Assortment. Individual Lowe's stores typically stock about 35,000 products each. The company appeals to consumers who have a preference for a one-stop shop for project supplies and also provides an array of brand-name products that appeal to pros and DIYers who are brand loyal.

Fresh Focus on Pros. Professionals spend significantly more money per year at Lowe's stores than DIY customers, so a renewed focus on serving pros better is a good move for the company to grow sales.

Weaknesses

Lost Focus on Pros. Originally a primarily pro-serving business, Lowe's has lost its lead in serving pro customers, supplanted by Home Depot as professional customers' destination for buying full projects' worth of supplies. Lowe's now has a reputation to rebuild with pros.

Side Projects. Lowe's has dabbled in expensive side projects that have detracted from its core business. Shutting down operations in Australia and Mexico and reducing its footprint in Canada, as well as shedding its Orchard Supply Hardware chain in the U.S., have been costly.

Size. Company size can be a weakness if Lowe's is unable to adapt rapidly enough to meet customers' needs in an evolving retail environment.

Locations. Lowe's has a history of building stores in rural areas, which has pros and cons. Rural locations tend to serve a less affluent customer base. The company also began operating prior to Home Depot, so it has had comparative disadvantages due to having some older, retrofitted buildings and locations that are no longer prime for development.

E-Commerce. Lowe's has long had an outdated online selling platform and has been behind general retail and Home Depot in building the robust e-commerce presence customers expect and a supply chain to support it.

Customer Service. Like other big-box stores, Lowe's has a reputation for customer service that is less personal and less helpful than independent stores provide. An outdated e-commerce site and poor execution of its buy online, pickup in store and home delivery options enforce a less-than-stellar customer service image.

Business Seasonality. Weather impacts Lowe's operation heavily due to the retailer's reliance on selling seasonal goods, such as lawn and garden products in the spring and snow clearing equipment in the winter.

Opportunities

Professional Customers. On average, professional customers spend more money at home improvement businesses compared to consumers. Lowe's has opportunities to improve relationships with existing professional customers and attract new pros through an expanded pro loyalty program and its hiring spree to expand in-store staff to provide strong customer service to pros specifically. The company's efforts to promote skilled trades through an employee apprenticeship program and a program for high school students also show promise to improve its reputation with pro customers.

E-Commerce. Continuously updating its website and focusing on improving its e-commerce presence would improve Lowe's ability to compete in an arena where customers now expect a seamless multi-platform experience that includes websites, social media, mobile apps and in-store shopping.

Home Decor and Appliances. Both home decor and appliances are categories Lowe's already sells and has the opportunity to gain market share in. Other retailers, including Sears, J.C. Penney and Bed, Bath & Beyond, have dominated segments of those categories but are struggling to survive.

Expert Service. Home Depot has improved its customer service reputation in recent years and many independent retailers have made names for themselves by offering expertise and top-notch service. Lowe's could improve its service reputation and dramatically improve customers' experiences in stores by hiring experts in areas such as electrical and plumbing and improving employee training.

Supply Chain Investments. To support a growing e-commerce business and better serve pro and consumer store customers, Lowe's would benefit from making substantial supply chain upgrades. Home Depot has invested heavily in e-commerce and its supply chain in recent years and has reaped benefits Lowe's hasn't seen yet.

Threats

Major Big-Box Competitors. The home improvement sector has strong players. As the largest home improvement retailer in the U.S., Home Depot has long outpaced Lowe's in overall sales performance and cemented itself ahead of Lowe's in areas such as pro sales. Menards, though significantly smaller, is working to improve the omnichannel shopping experiences it offers and has set itself apart with a lowest-price reputation. General retailers, such as Walmart, and online retailers like Amazon also compete with Lowe's in some product categories and have changed customers' expectations for omnichannel shopping, fast delivery and pricing.

Cyber Threats. The more ways customers can engage with and buy from Lowe's digitally, the more risky data breaches could become. Having hackers steal customer data could result in lost customer trust, expensive lawsuits and lost sales.

Independent Retailers. In the home improvement industry, independent operators can adapt to changing customer needs and the evolving retail world more quickly than large corporations. In addition, they can provide hyper-local products and services and offer highly personalized customer service.

Socioeconomic Uncertainty. Lowe's has survived the Great Depression, 2008's economic downturn and multiple wars. However, a pandemic, riots, city curfews, political changes and other factors contributing to economic and social uncertainty could impact Lowe's ability to maintain and grow sales long term.

Supply Chain Interruptions. Lowe's ability to meet customers' expectations is dependent on the company's ability to source products when consumers and pros need them. Major logistics problems could damage Lowe's reputation and hurt its ability to grow.

Expert Perspective: Where the Company Is Headed

Jonathan Matuszewski is a vice president at Jefferies, an international financial services company. He covers the hardlines retail sector, including companies in home improvement, home furnishings and consumer electronics.

Jonathan Matuszewski is a vice president at Jefferies, an international financial services company. He covers the hardlines retail sector, including companies in home improvement, home furnishings and consumer electronics.

Hardware Retailing (HR): How are recent company changes improving Lowe’s?

Jonathan Matuszewski (JM): We haven’t seen this amount of change going on at the organization in a long time, beginning about two years ago with bringing in Marvin Ellison as the new CEO, followed by other new hires. New talent, the sense of urgency to bring positive change to the company and efforts to improve a lot of deficiencies in systems and protocols are positives for the company.

Lowe’s is pursuing the standard tenets of a retail turnaround strategy. Ellison is looking to take a honed, strategic focus on the U.S. business. They’re looking to simplify the Canadian banners. They’ve closed over 85 underperforming stores since Ellison’s been on board. That’s going to improve the overall profitability profile of the U.S. business going forward.

HR: Do you view the company as needing a turnaround?

JM: It’s a turnaround in terms of internal talent and systems and processes to capitalize on a pretty supportive macro backdrop. Clearly there’s some near-term uncertainty with everything going on with COVID-19, but Lowe’s is seeing robust growth as people are doing DIY projects. Lowe’s is also benefiting from household appreciation, lower interest rates, millennial household formation and a healthy spending stream from aging baby boomers. Lowe’s historically hasn’t been able to capitalize on some of those industry tailwinds but new talent, priorities and initiatives are helping.

HR: What are examples of new initiatives?

JM: In Ellison’s first few months as CEO, he went into stores and tried to get a sense of why pros weren’t shopping there. Historically, the pro customer has viewed Lowe’s as more of a fill-in trip and not their complete destination for a job. Basic changes for Lowe’s have included adding more job lot quantities at volume discounts to appeal to a pro customer, who needs larger quantities of goods than DIY customers and expects some level of discount for purchasing at those levels. Lowe’s is adding more pro department supervisors. The pro, for Lowe’s, is eight times more valuable than the DIY customer. These efforts to grow pro spending are trying to drive sales productivity at the store level.

We’re going to see a big emphasis on the Lowe’s pro loyalty program. The new program has been rolled out and has some upgrades that could be pretty powerful in terms of reengaging existing pro customers or acquiring new ones. Management is already seeing momentum with new pro customer acquisition. They’ve improved their stores and product assortment. There’s more work to do, but they want to reach out and reengage lapsed or new pro customers and let them know that they have the in-stock inventory levels and they’re adding new brands focused on the pro.

HR: Home Depot’s 2019 sales were $110 billion and Lowe’s were $72 billion. Why is Lowe’s so far behind?

JM: A lot of it goes back to the pro. If you take a look at some of the statistics that Home Depot and Lowe’s have shared about their pro penetration and pro spending attributes, that’s one of the reasons why Home Depot’s boxes are significantly more productive. The last time we got an update from Home Depot, they said their average pro spent around $6,000 a year. At Lowe’s, the average pro spent around $2,250 per year. Only about 4 percent or so of Home Depot’s customers may be pros, but those are actually accounting for 45 percent of sales. Pro is king and always has been. Now we’re starting to see some interesting things Lowe’s is doing on the pro side to try and close that gap.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information