The home improvement channel has seen 2020 as a year of renewed focus. With more people from all walks of life rethinking exactly what they want from their homes, analyzing home improvement shoppers’ behaviors, inspirations and new retail preferences can help you anticipate your customers’ needs and meet them precisely.

Market research firm The Farnsworth Group has partnered with the Home Improvement Research Institute (HIRI) for the comprehensive 2020 Retail Selector Study, a factor-by-factor analysis of what DIYers are buying, where they’re shopping and what outside factors are motivating their purchases.

Conducted from April 17 to May 15, the 2020 Retail Selector Study is a clear assessment of the current home improvement market, reflecting the clashing influences of COVID-19, a patchwork of stay-at-home orders and the reality of new ways of living and working for millions of Americans.

Grant Farnsworth, managing partner of The Farnsworth Group, says understanding consumer behavior is critical, especially as COVID-19’s effect on retail sectors looms large.

“The study offers a thorough analysis of what exactly has motivated shoppers’ most recent home improvement purchases,” he says. “We can see what DIYers are buying in home improvement, where they are going for purchases and why.”

Read on to discover topline discoveries from the study and key takeaways to guide your business in the months ahead.

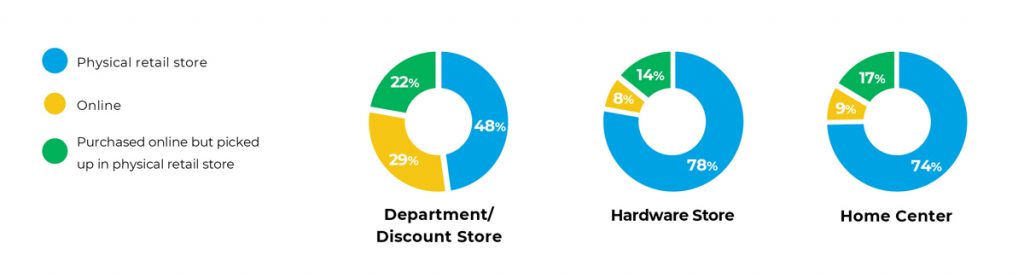

How DIYers made their most recent home improvement purchase

Note: ‘Home centers’ denotes big-box chains like Home Depot, Lowe’s and others. ‘Hardware stores’ counts independents. ‘Department stores/ discount’ refers to Walmart, Target, etc.

Source: 2020 Retail Selector Study

Market on the Move

One of the key strengths of the 2020 Retail Selector Study is its sample size. The study includes insights from more than 2,000 adults who had made home improvement purchases in the past three months, giving high-performance retailers an incisive look at their customer base.

One of the key findings from this year’s data is that shoppers are on the move. More than 20 percent of respondents say they plan to buy or sell a home in the next 12 months, more than doubling the rate found in 2016 and nearly 10 percent higher than the 2018 results.

“This growth ties into what we’re seeing elsewhere in the market regarding new home construction and existing home sales,”

Farnsworth says. “New home sales are up month after month, and we’re starting to see some really strong forecasts for single-family housing starts in 2021.” Farnsworth says real estate shifts can be attributed to the nesting phenomenon observed during COVID-19 wherein homeowners begin to make plans for long-term comfort and versatility in their homes. For many, this nesting phenomenon has prompted research into possible home renovations and actual construction activity.

Brick and Mortar Remains Powerful

Home improvement retailers across North America have seen sales rise during COVID-19, and many are now seeing increased in-store foot traffic as the early days of the pandemic have passed.

More than 90 percent of respondents who made their purchases at hardware stores visited that business in person. Brick-and-mortar traffic also follows generational customs, too. Roughly 80 percent of baby boomers visited a physical retail store for their purchases, while 61 percent of Gen X and 45 percent of millennials also visited a physical store for their DIY products.

Millennials were the biggest patrons of buy online, pickup in store services, with nearly one-quarter using that option for their home improvement purchases.

Considering shoppers of all types of home improvement locations, 72 percent of males and 85 percent of females visited a brick-and-mortar store for home improvement products.

Every Category Is in Play

Of the 15 major home improvement product categories charted in the study, only two saw year-over-year declines in purchases (lumber and plumbing). Farnsworth says this cross-category growth is indicative of a truly engaged consumer base.

“It’s interesting that electrical and HVAC saw small sales bumps. Those aren’t categories normally associated with DIY activity, but as more people have time on their hands or want to limit contractors entering their homes, spending in those categories is increasing,” Farnsworth says.

On average, study respondents purchased 20 percent more home improvement product categories per purchase occasion than in 2018 and spending per occasion rose 5 percent.

Availability Is Absolutely Key

One of the strongest takeaways is the fact that product availability is quickly becoming the most important motivator for DIYers’ product purchases, sometimes outpacing price and convenience.

“The concept of product availability—getting what I want, when I want it—is becoming critical,” Farnsworth says. “Price and convenience as purchase motivators have dropped. That’s not to say they’re not important, they still are, but in context of availability, many shoppers may be willing to trade off.”

Data from the North American Retail Hardware Association confirms independents are keenly focused on this customer mandate. More than one-third of home improvement retailers are making purchases through more suppliers during the pandemic. About 20 percent of retailers have begun ordering items directly from manufacturers more often.

How Your Customers Shop

The complete 2020 Retail Selector Study includes more than 300 pages full of data on what motivates today’s home improvement shoppers and is available exclusively to HIRI members. Use the information below to learn more about your modern shoppers. Visit The Farnsworth Group online at thefarnsworthgroup.com and HIRI at hiri.org.

Cross-shopping is a growing trend.

The study notes an increase in project types and among home improvement shoppers, leading to a rise in cross-shopping behavior. Shoppers are buying more products in multiple categories at once, possibly motivated by a desire to reduce retail visits during COVID-19.

Mobile devices are a new home improvement tool.

Alongside a hammer, nails and paint, customers are viewing their mobile devices as an essential tool for any DIY project. Nearly half of millennials used their mobile devices to research project how-to information, and about 40 percent of Gen Xers used a retailer’s mobile app to compare product prices.

Customers want to be inspired.

In every product category, 70 to 90 percent of shoppers gathered information online before making a purchase. With more shoppers than ever making a majority of their home improvement product purchases online, online video sites and retailers’ websites also grew significantly as sources of information for customers.

Shoppers value the convenience of hardware stores.

DIYers were asked what motivated them to choose the type of retailer they eventually used for their purchases. For hardware store shoppers, convenience was the biggest motivator, beating big boxes in this respect. Variety of products was the second most powerful motivator, followed by customer service.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information