Click the picture to download a PDF of this story now.

Though there has been a lot of hushed talk in recent months about the R-word looming on our economic horizon, economist opinions are certainly split about whether a recession may be headed our way.

While market watchers continue to debate the meaning of current economic indicators and the state of the housing market, all the signs we look at point to slower economic growth for the home improvement industry over the next several years.

Similar to 2018, unemployment is low, wages are up and home prices have been on the rise.

Since the last recession, home improvement spending and investment in housing and remodeling have all seen steady growth. This growth has helped sales through home improvement retailers outpace overall retail growth for years.

However, in 2019, we saw signs that the strength of the home improvement retail market may be slowing.

After getting year-end results for 2018, we revised our year-over-year growth predictions from 2017-2018 down to 4.8 percent (from 5.5 percent).

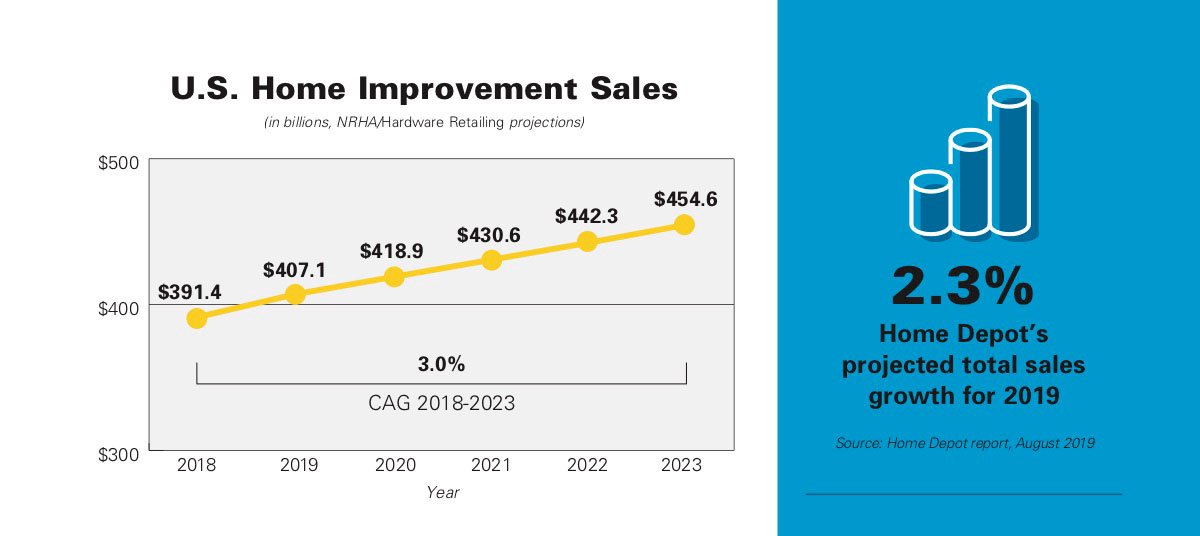

We saw growth throttle back in 2019 and are currently predicting the year will end with sales of $407.1 billion for the industry, with year-over-year growth in 2020 of about 3 percent.

Market Expectations

Looking ahead to year-end results and beyond, the slightly grim news is that we see 2019 being the best growth year for the industry in our five-year forecast. We expect compound annual growth from 2018-2023 to run only at slightly more than 3 percent, well below the 4 to 5 percent we saw in the recent past.

An article in the Oct. 24 edition of The Wall Street Journal uses data from the Joint Center for Housing Studies of Harvard University to sum up rather well some of the challenges the home improvement industry is facing.

“Following years of 5 percent to 7 percent growth in spending since last decade’s housing crash, Harvard’s model has been predicting slower growth for the past year or so and an outright decline next year for the first time since 2010,” the article states.

The reasons for the market softening mainly revolve around fewer large construction projects and less homebuilding activity, slower sales of existing homes and diminished remodeling work.

However, as we have seen in the past, even as some of these higher-priced projects slow, homeowners don’t stop spending when their bathroom sinks need to be repaired and kitchen walls need to be painted.

What all this means is that we expect home improvement industry sales to slow in the coming years as larger projects get put off, though interest rates could impact this trend in either direction.

At the same time as large construction and remodeling projects slow, smaller home updates and repairs will take on more prominence for home improvement customers. Over the next five years, we predict people will continue investing in their existing houses, even if large-scale remodels diminish in priority.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information