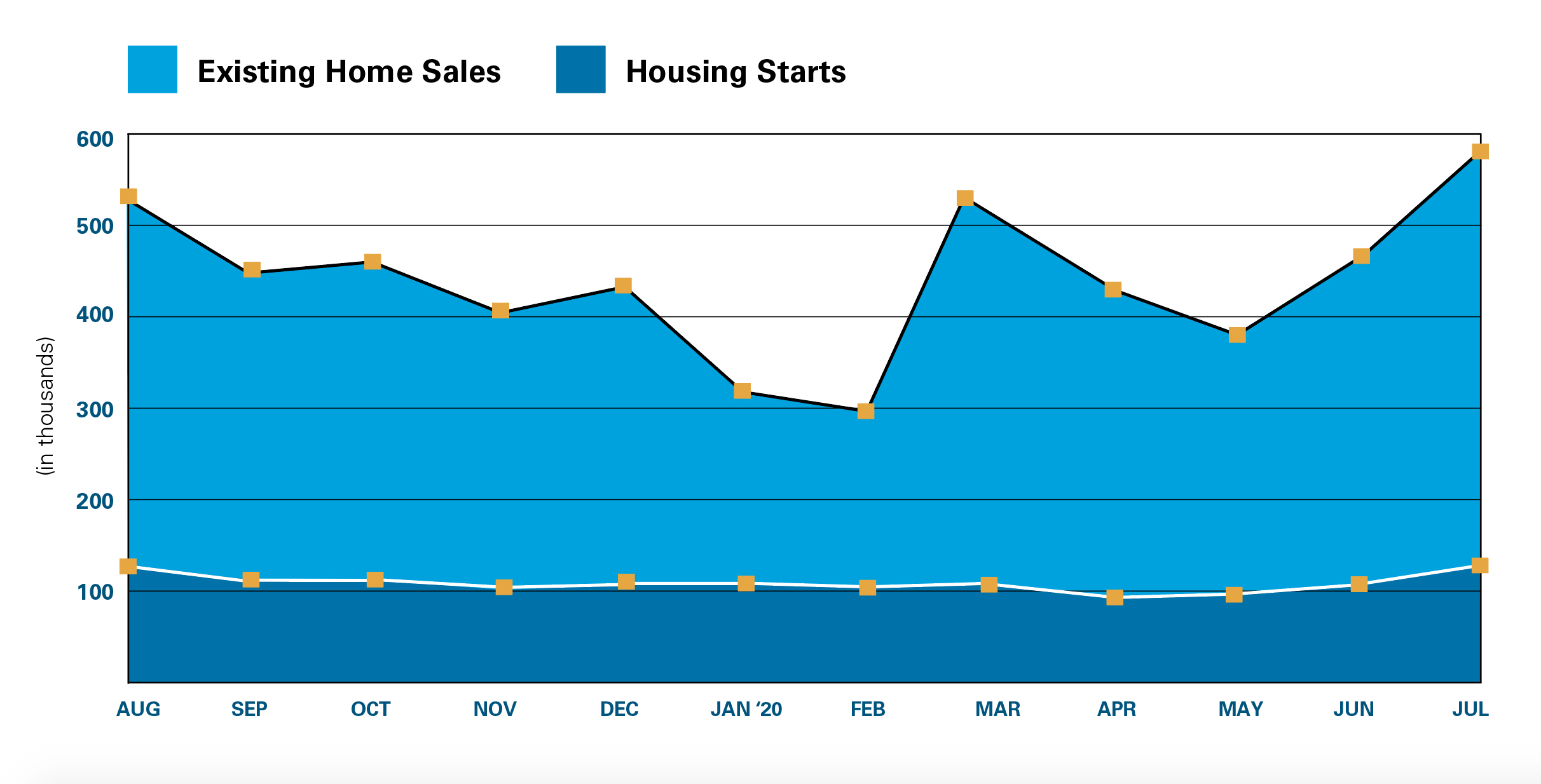

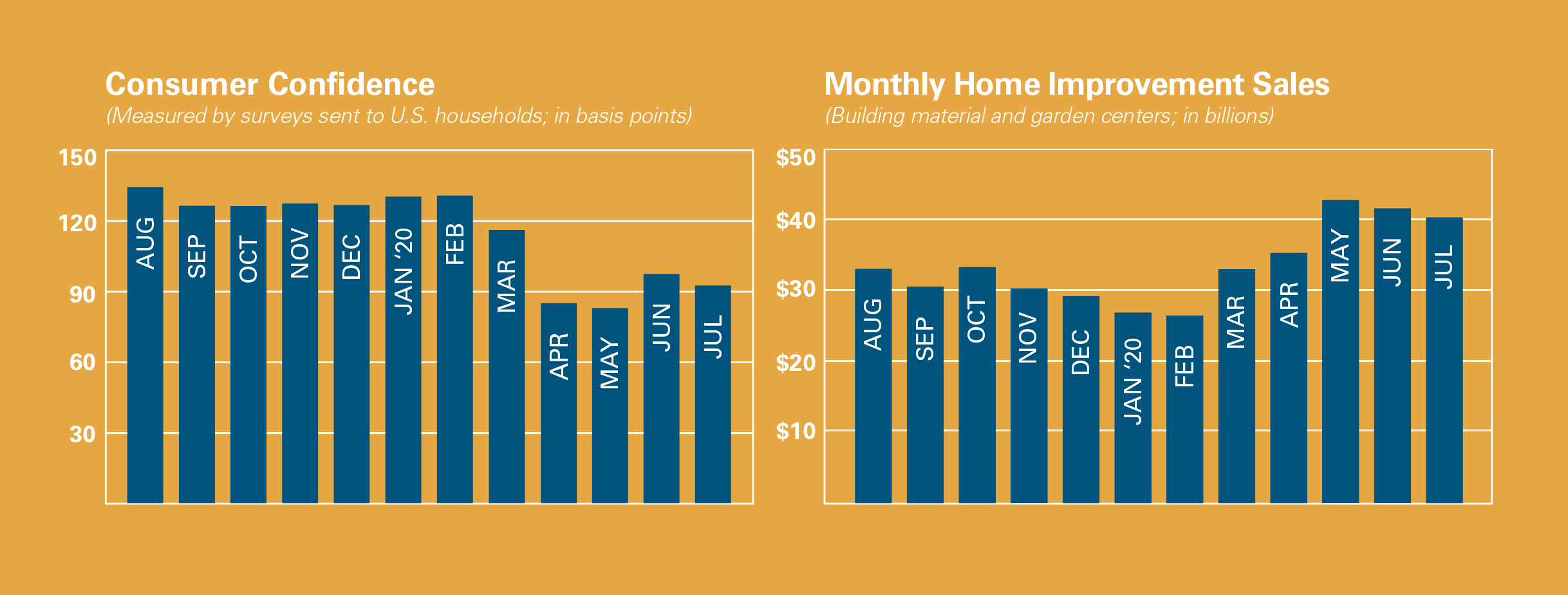

Monitoring market trends in consumer sentiment, home improvement rates and construction figures can help you anticipate emerging opportunities for your business. Use the tables below to get a deeper understanding of a few of the forces affecting independent home improvement. Data is not seasonally adjusted, meaning these graphs represent real-time shifts in the market.

- Understand consumers’ desire to save or spend by gauging overall consumer confidence levels.

- Analyze total retail sales for building material and garden equipment centers to track your business’s performance against national averages.

- Serve customers renovating or upgrading homes more effectively by observing housing starts and existing home sales.

Existing Home Sales and Housing Starts as of July 2020:

Existing Home Sales and Housing Starts as of July 2020:

Sources: National Association of Realtors; U.S. Census Bureau

Sources: National Association of Realtors; U.S. Census Bureau

Housing Market Sails Through Recovery

“The housing market is well past the recovery phase and is now booming with higher home sales compared to the pre-pandemic days,” said Lawrence Yun, the National Association of Realtors’ chief economist. “With the sizable shift in remote work, current homeowners are looking for larger homes and this will lead to a secondary level of demand even into 2021.”

The median existing-home price for all housing types in July was $304,100, up 8.5% from July 2019 ($280,400), as prices rose in every region. July’s national price increase marks 101 straight months of year-over-year gains. For the first time ever, national median home prices breached the $300,000 level.

Consumer Confidence and Monthly Retail Sales as of July 2020:

Consumer Confidence and Monthly Retail Sales as of July 2020:

Sources: The Conference Board; U.S. Census Bureau, NAICS 444

Sources: The Conference Board; U.S. Census Bureau, NAICS 444

Consumer Confidence Sees Two Months of Declines

“Consumer confidence declined in August for the second consecutive month,” says Lynn Franco, senior director of economic indicators at The Conference Board. “The Present Situation Index decreased sharply, with consumers stating that both business and employment conditions had deteriorated over the past month. Consumers’ optimism about the short-term outlook, and their financial prospects, also declined and continues on a downward path. Consumer spending has rebounded in recent months but increasing concerns amongst consumers about the economic outlook and their financial well-being will likely cause spending to cool in the months ahead.”

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information