By Scott Wright, swright@nrha.org

To view a PDF of this story, click here.

In any typical home improvement store, there are generally six or seven core hardlines departments that do the “heavy lifting” of generating sales and gross margin dollars for the entire store. These departments typically include hardware and fasteners, electrical and lighting, plumbing and heating, hand and power tools and accessories, paint and sundries and lawn and garden.

While stores may have additional niche departments, these six core categories are really what drive customers to home improvement stores. And within each of these core departments are core categories that are the key profit drivers. For example, liquid paint is generally the top-performing category within the paint and sundries department, comprising roughly a third of departmental sales, according to past research from the North American Retail Hardware Association (NRHA).

So when sales start to wane or shift in one of these key areas, it can become a major issue for any business. But how do you handle it? What steps do you need to take?

Read on to learn how one company took drastic measures to revitalize its paint department, and find some tips on how you can assess the core departments and categories in your store to keep them in tip-top shape.

Understanding the Changes

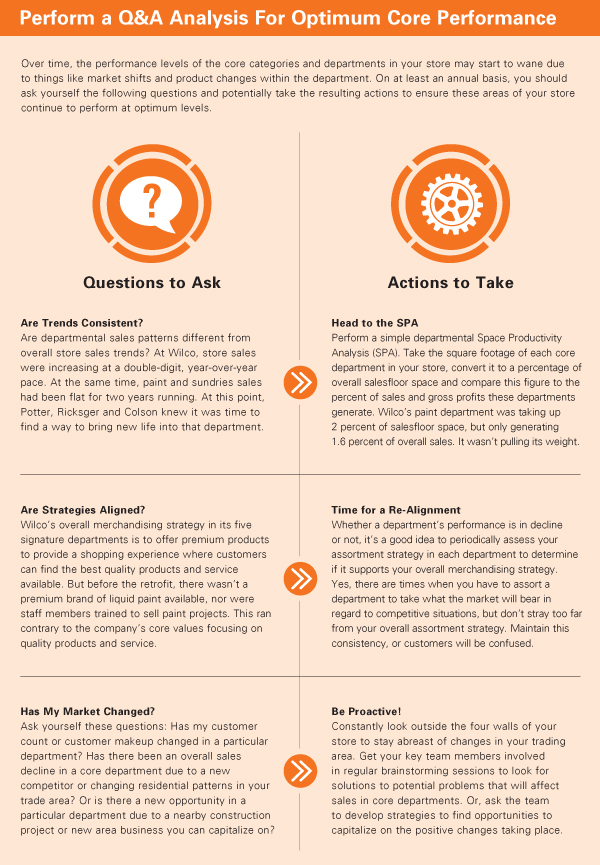

Before you can develop any plan of action, you need to address flagging sales in a core department. It could be many things, including, but certainly not limited to, market changes, an undesirable product selection or new competition.

Some changes are simply the result of an evolving marketplace. For example, consider some of the changing government regulations in core categories such as lawn and garden chemicals and oil-based paint, where key ingredients have been banned by the Environmental Protection Agency.

While you may not have thought about its long-term impact, think for a minute about the phase out of incandescent bulbs and the move to longer-lasting options like LED light bulbs will have on your store. On one hand, today’s LED bulbs, at current pricing levels, generate a lot more sales and gross margin dollars per unit sold than their incandescent counterparts.

But, while that’s the case now, the Alliance to Save Energy, a nonprofit coalition of business, government, environmental and consumer leaders advocating for enhanced energy, predicts the price point of LEDs will “drop drastically in the coming years as demand increases.”

It wasn’t that long ago that incandescent bulbs were hot promotional items at hardware stores and were featured on the front pages of circulars from coast to coast. They drove traffic to independent stores. LEDs now last up to 25 times longer than incandescent and 10 times longer than fluorescents. And while they are no doubt better for the environment, the tradeoff at retail will likely be a negative effect on overall store traffic, and fewer footsteps in the electrical department.

It’s not just changing regulations that can affect core department performance, either. Sometimes market forces are responsible. Consider trends in the power tool category back in the 1990s and early 2000s, when many independents completely abandoned their assortments due to overwhelming price and competitive pressure from the big boxes.

While we’ve seen the return of this category to the aisles of many independent stores today, the assortment strategy was forever impacted as a result.

Like maintaining physical fitness, there are no easy fixes or magic pills you can take to revitalize an “out-of-shape” core department or category. It takes working out the issues that are responsible, and a solid plan for continuous improvement.

That was the strategy that store manager Michael Potter, merchandise manager Trent Ricksger and district manager TJ Colson, three management employees from Wilco, examined as part of their Business Improvement Project while attending the NRHA Retail Management Certification Program (RMCP) in 2013. Their project focused on revitalizing sales and profitability of the company’s paint and sundries department, and this is a comprehensive account of what they did, and the results of their efforts.

The Challenge

Wilco is not your typical home improvement retailer. With 18 stores throughout Oregon and Washington, Wilco’s niche in its competitive arena is that of a regional farm and home lifestyle destination store. It caters to a higher end clientele that includes consumers and hobby farmers living in suburban and rural markets throughout the region. These upscale customers value the quality products Wilco offers. In fact, “quality” is one of Wilco’s core values, and there is a tremendous emphasis placed on stocking quality products and providing quality service.

While the retailer stocks a full-line hardlines assortment, overall hardlines sales account for just 15 percent of overall revenue. And sales in Wilco’s paint and sundries department only accounted for 1.6 percent of overall store sales in 2013. In contrast, many home improvement retailers in the industry rely on their paint and sundries department to generate between 8 and 12 percent of overall sales, according to past NRHA research.

The problem at Wilco was that paint and sundries sales were flat in 2012 and 2013 during a period when overall store sales were growing at a double-digit clip. The department was clearly underperforming. Potter, Ricksger and Colson were tasked with two goals for their project.

First, they had to find a strategy to bring departmental sales back in line with the overall store growth figures the company was experiencing. A departmental Space Productivity Analysis revealed Wilco was dedicating 400 square feet of salesfloor space (2 percent of overall square footage) to paint and sundries, but the department was generating just 1.6 percent of sales and showing no signs of growth.

Second, Potter, Ricksger and Colson began researching and selecting a premium brand of liquid paint to help foster the same quality perception in paint and sundries that consumers have for other key areas of the store.

Wilco’s strategy lies in finding categories of the store that complement each other from a competitive standpoint, according to Sam Bugarsky, Wilco’s Chief Operations Officer. “Big boxes don’t do garden well, and nurseries can’t do hardlines well, so the combination is key for us,” he says.

Wilco’s merchandising strategy also includes stocking what they call “Market Leader” categories.

“We want to have the best selection, the right pricing and some expertise in our Market Leader categories,” says Bugarsky. “We want to be known as a destination store for these categories, and we have about 20 or so that are consistent from store to store.”

So the plan for Potter, Colson and Ricksger was clear—try to find a way to turn paint and sundries into a Market Leader category for Wilco. (And, if that wasn’t possible, they would have to find a better use for the space.)

Cross-Country Research Trip

The first step for the Wilco trio was to plan a cross-country trip to Aubuchon Hardware’s corporate office in Westminster, Massachusetts, in March 2014, for a meeting of the minds. Two Aubuchon employees had shared details about the recent reset of the paint and sundries departments in each of Aubuchon’s 107 stores. They also shared pictures of how they had integrated a store-within-a-store decor theme. Intrigued by the strategy, the trio wanted to see it firsthand.

Aubuchon’s store-within-a-store included a full assortment of Benjamin Moore paint, using elements of the paint retailer’s signature decor theme. The space also featured tables and chairs at the entrance to the department to allow customers a place to sit down and consult with paint staff on everything from color and sheen to overall decorating project needs. It even included a TV monitor playing how-to videos or HGTV programming to position the space as more of an idea center than just a place in the store where paint is mixed.

“We liked Aubuchon’s strategy of incorporating an experience area so customers can come in and feel more comfortable shopping, like at a professional paint store,” says Potter. And having integrated a store-within-a-store concept in Wilco’s lifestyle clothing department several years prior, and seeing dramatic sales increases as a result, Potter, Colson and Ricksger knew a similar concept could work in the paint and sundries department as well.

Shortly after the meeting with Aubuchon, the decision was made to move forward with a more conservative version of a store-within-a-store.

Shortly after the meeting with Aubuchon, the decision was made to move forward with a more conservative version of a store-within-a-store.

“We don’t generally invest much in store decor,” says Colson. “We keep it simple and neutral. But we wanted to incorporate the paint decision area with decorative flooring and lighting to highlight the department.” The plan also called for keeping the size of the department within its existing 400-square-foot space.

The Wilco team also liked the premium brand assortment strategy being employed by Aubuchon.

“We knew we needed to have a premium brand to coincide with our overall focus on quality, and after our category managers completed their research, we chose Benjamin Moore as well,” says Ricksger. “One key factor we considered is that there aren’t a lot of Ben Moore dealers in the markets where we have stores. But we didn’t go into this project trying to make Ben Moore work; we went into it knowing we had to make a premium brand work.”

The go-forward strategy would include adding the full line of Benjamin Moore liquid paint to the existing private-label paint assortment from Wilco’s co-op, which would be used to provide both entry- and mid-level pricing options.

The Training Component

It was clear to Potter, Colson and Ricksger that their massive paint and sundries department reset project, which included eight existing stores, would address the five “Ps” of marketing and differentiation: product, placement, people, price and promotion. Since they had already identified the product (paint) and their trip to Aubuchon offered insights on placement, it was time to move on to the next major piece of the puzzle—people, and the training that was needed to tie it all together.

The Wilco team knew they needed to make the investment in additional training for the re-launch to be successful, so they worked with their co-op reps and the training team from Benjamin Moore to develop a comprehensive curriculum they could use to train staff members to become not only paint experts, but paint and decorating sales consultants.

“We knew if we were going to be investing in this major reset project, we needed to have someone on hand all day who could consult with customers and actually sell paint, not just someone who could mix up a gallon,” says Potter. “We needed to make sure everyone—from the store managers and hardware area specialists to PICs (people in charge) and sales staff members working in the department—would have the necessary knowledge to sell paint effectively.”

The initial training curriculum included five hours of online paint training offered by Benjamin Moore, and another half day of in-store training offered by their co-op’s paint training specialists. Colson admits that up to this point, they hadn’t been using all of the resources that were available to them.

“Previously, we just trained our people how to mix paint. We didn’t regularly send people to the regional training sessions that were available to us, and we found that these sessions were very educational,” he says.

“We eventually came up with our own full-day training session that also focused on selling sundries and other key brands within the department, because if we are going to be selling a $70 gallon of paint, our people better know why it costs this much,” adds Potter.

Pricing Strategy

To develop a pricing strategy for the new premium assortment, the trio knew they needed to make the transition from paint being a loss-leader promo item to bringing it in line with Wilco’s overall pricing strategy—which is to be competitive, but not the cheapest in town. “Previously we would only sell paint during a BOGO (by one get one) promotion,” says Colson.

“I once heard that of the five Ps, you have to win at least three to be successful,” explains Ricksger. “We think we win at four of them, and that they are differentiating factors for us. We know we don’t win at price, but we’re confident that we are competitive.”

The focus was now on selection. With the addition of Benjamin Moore, Wilco now offered a variety of price points, ranging from $23 to $70 for a gallon of paint, with options covering all points in between.

Marketing the Reset

The strategy to promote the new paint and sundries department called for starting at the individual store level until all existing stores were retrofit and uniform in appearance and assortment.As a store retrofit project would reach completion, the Wilco marketing team would post special messaging to social media to promote that change as a special store event to regular customers, highlighting the new premium brand offering. Special postcard mailings also were sent out, and free samples were provided at special events, such as the company’s popular Ladies’ Night. The full-scale promotion of the new department re-launch didn’t come until mid-2015, after all of the store retrofits were complete.

At that point, store staff chose to highlight the new paint assortment prominently in circular ads.

It didn’t take long to see results. “The first store we retrofitted was McMinnville in July 2014, and true comp numbers for that store for 2014 vs. 2013 saw sales spike from $187,000 to $210,000 in overall departmental sales, with just five months of results and very minimal marketing,” says Potter. “We saw the same thing in two other locations, so we knew it was working.”

Return on Investment

Overall, Potter says the company spent between $13,000 and $16,000 per existing store to retrofit the departments. This included adding the new lighting and flooring, as well as general construction expenses. While the retrofits were taking place, Wilco opened four new stores with the new decor elements and assortment strategy in place.

As with any major store project, coordination and communication with key vendors was a top priority, as Wilco received assistance on both equipment and product buybacks. Likewise, projects at existing stores were scheduled in conjunction with other full-store remodeling projects to minimize cost and store disruption. “Our major expense was the additional $120,000 we spent on liquid paint inventory to bring in Benjamin Moore, but it was a necessity to make the statement that we are really in this business,” says Ricksger.

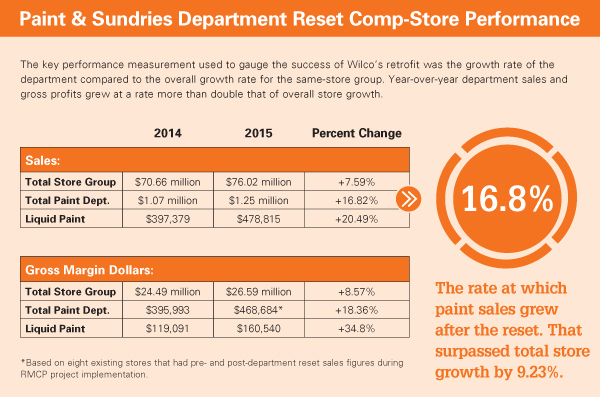

On a comp-store basis, of the eight existing Wilco stores that went through a paint and sundries department retrofit, the results exceeded overall store growth results—some by a large margin. While year-over-year total sales growth from 2014 to 2015 increased by 7.6 percent for the comp store group, year-over-year paint and sundries department sales (which were flat the previous two years) grew by approximately 16.8 percent, or $180,000. This outpaced overall store growth by 9.2 percent.

And the liquid paint category saw more than a 20-percent sales growth year over year on a comparable-store basis. (For a comprehensive look at individual comp-store results, go to TheRedT.com/store-results.)

And the liquid paint category saw more than a 20-percent sales growth year over year on a comparable-store basis. (For a comprehensive look at individual comp-store results, go to TheRedT.com/store-results.)

As for gross profits, the re-launch of the paint and sundries department generated an additional $72,691 gross margin dollars in 2015 vs. 2014 as a result of the resets (an increase of 18.4 percent), outpacing total comp-store gross margin dollar growth by double digits.

While it didn’t cover all project expenses in year one, it came close. More importantly, it set the paint and sundries department on a new growth trajectory that has continued for the first half of 2016.

Potter, Colson and Ricksger admit their initial project goal of growing the paint department from 1.6 to 3.0 percent of total store sales was a stretch, and a performance metric that will likely take years to attain when you factor in the double-digit pace of overall sales growth for the company. But overall, they are pleased with the results.

Paying It Back; Paying It Forward

The diligence and hard work the trio put into their paint and sundries department re-launch project has definitely paid off for the company. The past year and a half of results shows it was a resounding success, and has even covered the majority of their RMCP course tuition. Today, that department’s growth continues to outpace overall sales and gross profit dollar growth by more than a 2-to-1 margin. Just as important, the three have taken a stagnant, underperforming category and realigned their merchandising and assortment strategy to make it consistent with the rest of the company.

For Wilco, paying it forward is another part of the ROI equation. Potter returns to Indianapolis twice a year as an RMCP alumni instructor and presents the project to current students.

“I remember when we were part of that first class and working on our project,” he says. “It would have been nice to have had a past student give details on how they went about completing their project.”

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information