To view the complete PDF of this story, click here.

By Renee Changnon, rchangnon@nrha.org, Kate Klein, kklein@nrha.org, and Melanie Moul, mmoul@nrha.org

Target has a reputation: The big-box retailer with flair.

The company’s stores are destinations for parents picking up groceries, newly engaged couples adding bedsheets to wedding registries, college students looking for dorm decor and fashionistas eager to buy out celebrity-designed clothing lines.

The first Target location opened in Roseville, Minnesota, in 1962—the same year Sam Walton launched Walmart, the largest big-box discounter in the world. Target’s parent business, The Dayton Company, didn’t race against Walmart to win at the lowest-price model, but distinguished itself as the upscale discount store.

Today, Target has maintained its chic image while competing for customers in a contracting brick-and-mortar retail market. At the same time, the company is also finessing its reputation to overcome setbacks such as an extensive payment card data breach in 2013 and the rapid dissolution of Target Canada in 2015.

To get past those obstacles and improve sales, the Minneapolis-based company announced in February that it is investing $7 billion to “support its plans, which include price reductions to get more people into stores,” the Minneapolis Star Tribune reports.

Throughout this story, we will look at how Target grew from a single store to a big-box chain with more than 1,800 locations and a growing e-commerce presence.

We will also highlight some of the company’s latest initiatives and its current financial position, as well as hear from an expert about its future prospects.

The History of Target

The department store that was the starting point for Target may never have come to fruition had the founder’s first investment project not been derailed by Minneapolis’ stringent liquor laws in 1901.

Banker, businessman and entrepreneur George Draper Dayton purchased property in Minneapolis, initially planning to build a 10-story hotel with a bar in the lobby. According to accounts from Laura Rowley’s book “On Target: How the World’s Hottest Retailer Hit a Bull’s-Eye,” the developers scrapped the plans when they found out liquor couldn’t be sold south of Sixth Street. The property was just one block south, on the corner of Nicollet Avenue and Seventh Street.

Instead, Dayton built a six-story retail store and convinced the owner of the fourth-largest department store in Minneapolis, Goodfellow’s Dry Goods Company, to move into the space, Rowley reports. The new store sold clothing and accessories, home essentials and housewares.

Dayton bought out his partners in 1903, gave the store his name and further developed the store’s reputation for “quality goods at fair prices, catering to a range of income levels,” Rowley writes.

For the next 50 years, The Dayton Company served the downtown Minneapolis community as a home goods department store. Two new stores were added in the mid-1950s before the company focused on a new retail opportunity—mass discount retailing.

Becoming Target

Target was established to capture shoppers who sought low-priced merchandise but a high-end shopping experience, founding president Douglas Dayton says in Rowley’s book. In the early 1960s, discount stores were fairly new to the retail market and had a reputation for stocking cheap goods in unkempt stores, Douglas says in the book. Because Target created a department store experience but sold low-priced goods, the store exceeded shoppers’ expectations, he says.

The first Target retail store opened in May 1962, according to the company. By the end of the decade, Target had expanded into four states outside of Minnesota and opened its first distribution center.

In 1979, Target posted $1 billion in annual sales for the first time and operated 74 locations in 11 states. Ten years later, after significant growth during the 1980s, Target opened 30 more stores in six states, all on the same day: April 30, 1989.

Expansion Plans

Target launched two new store formats in the 1990s. According to Target.com, the store featured “wider aisles, faster and more efficient checkout lanes and automatic teller machines (ATMs)” in addition to expanded pharmacy and photo services. The first Super Target opened in 1995 in Omaha, Nebraska, and highlighted the retailer’s interest in expanding into the grocery market, according to the company.

In 1997, Target launched a new donation initiative as part of its overall philosophy of giving to communities. The program donates 1 percent of all Target RedCard credit card sales to schools.

In 1999, the company entered e-commerce with the launch of Target.com, which now has 26 million unique monthly visitors and is the fourth most-visited retail site in the world, Target says.

Timeline: 1962 to Present

1962—In the Bull’s-Eye

The Dayton Company launches a discount store in Roseville, Minnesota, called Target. Three other locations open in other Minneapolis suburbs by the end of the year.

1979—Sales Records

With 74 stores in 11 states, Target achieves $1 billion in annual sales for the first time.

1988—Tech Savvy

Target introduces UPC scanning at all of its stores and distribution centers.

1990—Mission: Acquisition

Dayton-Hudson Corp., Target’s parent company, acquires Marshall Field’s department stores.

1995—Extra Credit

Target debuts its first store credit card, the Target Guest Card.

1999—Entering E-Commerce

The retailer launches Target.com

2000—Target Official

Dayton-Hudson Corp. becomes Target Corp.

2011—Target Official

Target acquires 189 Zellers store locations in Canada with plans to transition up to 135 of them into Target stores.

2013—Crisis With Data

Target experiences a data breach of its credit card processing systems, which affects more than 100 million customers.

2015—Canadian Collapse

In January, Target announces plans to exit Canada, and all stores are closed by May.

2015—Staffing Cuts

Target lays off 2,600 employees in the Minneapolis-St. Paul area.

2017—Growing Grocery

Target hires former Kroger executive Jeff Burt to lead its grocery business.

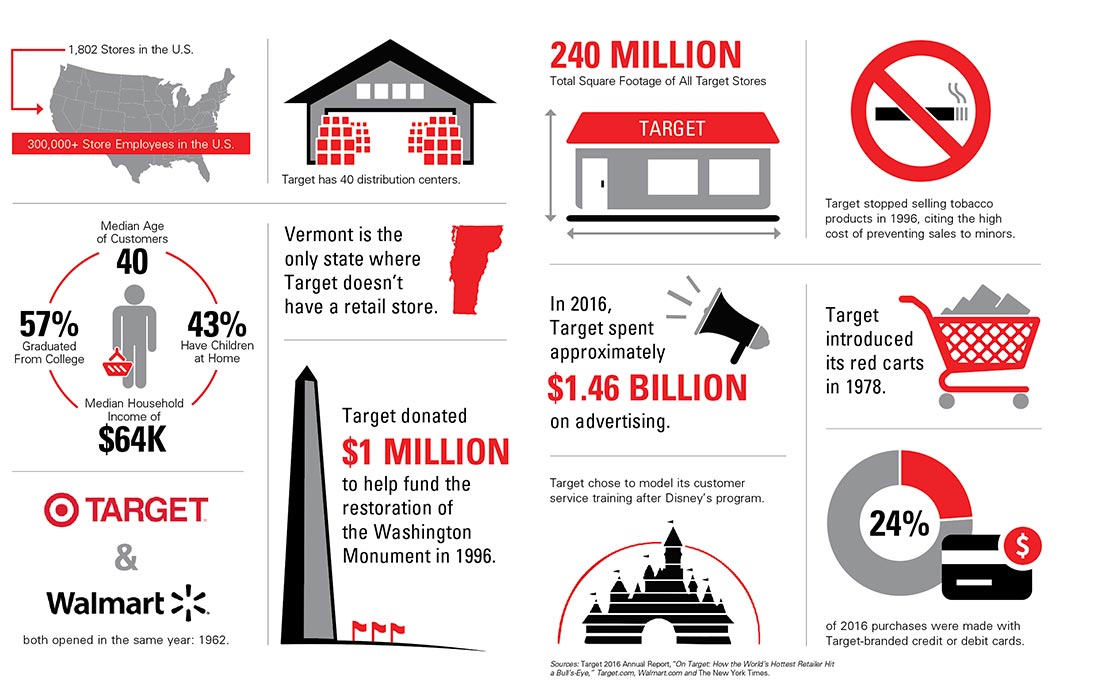

A Snapshot of Target

Target Today

Refocusing the Business

Refocus, simplify, prioritize and redefine are the key words for Target’s growth strategy under Target CEO and chairman Brian Cornell.

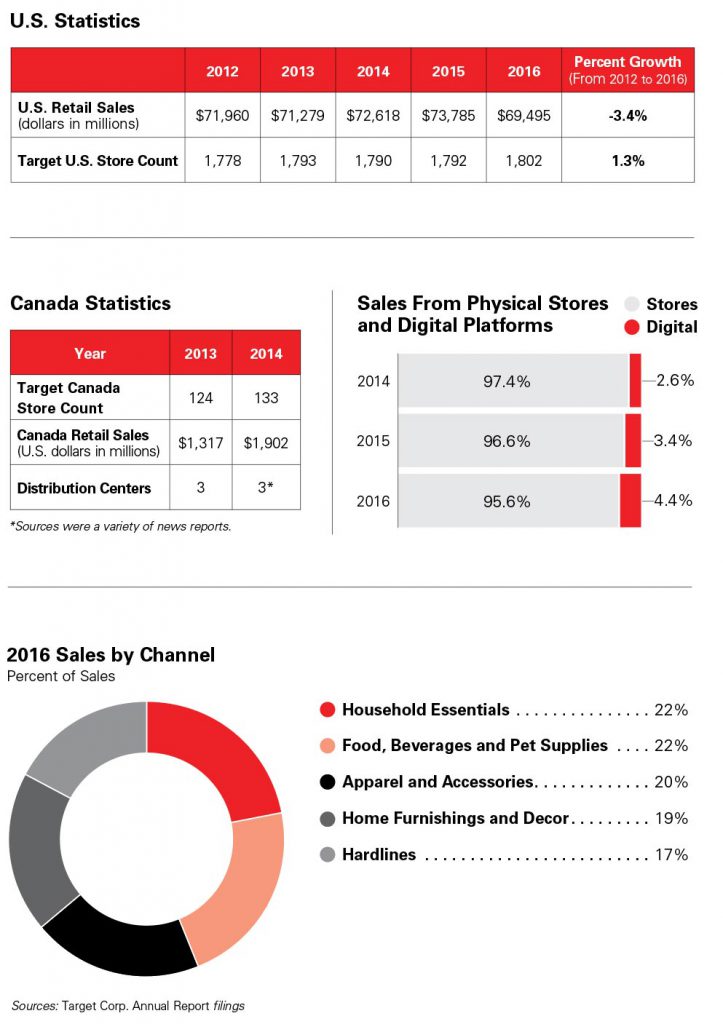

Shortly after Cornell joined the company as its top executive in 2014, he began leading rapid-fire changes. In January 2015, Target Corp. announced it would close all 133 of its Target Canada stores and its Canadian distribution centers.

The oldest Target Canada locations had been open barely two years. However, Target couldn’t come up with a plan for quickly turning a profit in Canada, Cornell said in a statement from the company.

“When I joined Target, I promised our team and shareholders that I would take a hard look at our business and operations in an effort to improve our performance and transform our company,” Cornell says in a press release.

Target’s leadership, including its board of directors, decided the company would benefit overall by leaving Canada to “focus on driving growth and building further momentum in our U.S. business,” Cornell says in a statement.

Target’s leadership, including its board of directors, decided the company would benefit overall by leaving Canada to “focus on driving growth and building further momentum in our U.S. business,” Cornell says in a statement.

Next, the retailer made plans to cut thousands of U.S. jobs, eliminating about 2,600 positions in the Minneapolis-St. Paul area alone, according to

the Star Tribune newspaper in Minneapolis.

That same spring, Cornell also led the sale of Target’s pharmacy business to CVS Pharmacy. The big box unloaded 1,672 pharmacies in that deal, according to Target reports. CVS now operates the pharmacies located in Target stores.

In the midst of dramatically shedding businesses and staff, Cornell described “simplifying how we work, and practicing financial discipline” as necessary for the company’s growth.

“We’re focused on our future and building the capabilities that will take us further, faster,” Cornell says in a press release.

When describing its refocus, the company’s leadership outlined plans for building seamless store, online and mobile shopping experiences; customizing its store product offerings for individual markets; differentiating its style, baby, kids and wellness categories; and testing smaller stores “to cater to guests in rapidly growing, dense urban areas.”

Zeroing in on what customers are looking for in retail experiences has included in-person interviews with shoppers, and even visits with customers in their homes, the Star Tribune reports.

“Redefining Target will require a renewed emphasis on prioritization and innovation,

and above all else, putting our guests first in everything we do,” Cornell says in a news release.

Technology Initiatives

To engage its customers, Target keeps technology at the forefront. From designing Target.com and mobile applications to using in-store beacons and opening Target Open House—a smart-home test store in California—the retailer is constantly looking for ways to deliver a seamless shopping experience.

Target.com and a New Approach to Online Fulfillment

Target has had a presence online since 1999, and from 2001 until 2011, the retailer had a partnership with Amazon.com to power its e-commerce offerings, according to Business Insider, an online business news source. In 2011, Target cut ties with the online bookseller, which was becoming a competitor.

In order to compete better online, Target announced in February that part of a $7 billion reinvestment into the company would be used to beef up its e-commerce business.

Target has been making efforts to push back against e-commerce competitors by investing in fulfillment capabilities at about 25 percent of its total retail locations, Cornell shared in February. In those stores, back rooms serve as online order fulfillment centers.

The company’s online sales were less than 5 percent of total sales in 2016, but are growing, according to the Target 2016 Annual Report. Brick-and-mortar store sales were down for the past few quarters, but digital sales grew more than 30 percent, the company reports.

Mobile Apps and an Integrated Shopping Experience

Target.com continues to be a focus for Target, as is an emphasis on mobile selling because of how frequently customers are shopping on mobile devices.

In June 2016, the retailer unveiled an updated Target.com, which provides a consistent and unified experience, no matter where a customer browses.

In addition, the company has created a variety of apps to help customers shop conveniently.

One of them, the coupon app Cartwheel, has become a popular way for consumers to save money at stores. Launched in 2013, Cartwheel has saved customers nearly $500 million, according to an April 2016 press release from Target. The app provides store maps to show customers where in the store they can find discounted items. Shoppers can also get emails and push notifications about special deals.

Target doesn’t currently offer mobile payment options in retail locations. But chief information and digital officer Michael McNamara told tech news source Recode that the retailer plans to introduce mobile pay features on one or more of its apps eventually. Doing so would be following the lead of retailers like Walmart and Kohl’s, which now offer their own mobile payment features that compete with Apple Pay and other payment apps.

Brick and Mortar Changes

Brick and Mortar Changes

As Target looks to the future and plans to invest in its digital experience, the company is also prioritizing reimagination of its stores.

The Retail Experience of the Future

The company emphasizes that its brick-and-mortar stores will play a major role in its success, regardless of digital growth, because of the experiences they offer.

At Shoptalk, a recent retail conference, Cornell discussed Target’s vision for its physical locations.

“Our guests still love shopping in Target stores—we’re known for creating a sense of inspiration and discovery that can’t be replicated online in quite the same way,” Cornell says.

“So while we are investing heavily in digital, we’re also doubling down on our stores to offer guests an elevated experience, and at the same time ensuring fast, easy pickup for online orders—giving guests every reason to keep coming to Target.”

In the next three years, Target plans to remodel and fully renovate more than 600 store locations.

The first of the redesigned stores is slated to debut in October near Houston. The store will provide two different shopping experiences, accessible through separate entrances, according to Target. One entrance will be designed to draw customers in to browse, and the other will be a quick stop for picking up web orders or groceries.

To further improve the customer experience, Target will also be giving store employees new tools. The plan is to provide technology that will allow workers to search for inventory, take mobile payments and arrange for deliveries, all from the salesfloor, according to Target.

Adding Locations, Decreasing Space

Although many retailers are scaling back on brick-and-mortar locations, Target’s investment in improvements will include new stores.

A new store being built in Texas that is 126,000 square feet will offer customers products from categories such as apparel, baby, home, electronics, health and beauty and grocery. It will be the prototype for the massive store remodels that the retailer is planning, according to the Minneapolis/St. Paul Business Journal. Plus, store services include an optical department, a pharmacy, Target Mobile and order pickup.

On top of revamping its existing locations, the retailer will be opening 30 small-format stores in 2017, which are primarily designed for urban markets and college campuses. By 2019, the company saysit will operate more than 130 small-format stores.

Unlike its typical stores that cover more than 100,000 square feet, the planned stores range in size from 20,000 to 50,000 square feet.

The smaller stores will be more customized to the markets where they are located. Depending on the location and its shopper demographics, Target will vary the merchandise selections and services. For example, a small store set to open in July at the University of Florida will bring college students dorm essentials, apparel and accessories, local sports team clothes, health and beauty products, grab-and-go groceries and will also serve as a pharmacy and order pickup location.

No matter the size of a Target location, the stores will remain just as important as e-commerce development, Cornell says in a press release.

“The future of retail is digital,” he said in his Shoptalk conference discussion. “And people will also be shopping in stores for a long time. So that means we need to keep investing in our stores to give guests every possible reason to shop.”

In addition to in-store pickup, Target will be using stores as fulfillment locations for local deliveries.

“Think of a Target store of the future being a hyper local, shoppable distribution center,” Cornell says.

SWOT Analysis

Strengths:

- Discount Chic: Target maintains a trendier, more upscale image than other general merchandise retailers such as Walmart and Kmart, while also using a discount model.

- Customers With Cash: Target stores appeal most to well-educated, middle-class customers who have money to spend.

- Philanthropy: The company, from its start, has built a reputation of generosity by donating 5 percent of profits to the communities where stores are located.

- Strong Business Partnerships: Target has partnered with well-known companies, including CVS Pharmacy and Starbucks, to offer in-store experiences with popular brands.

- Exclusive Collaborations: The company has found success with exclusive collaborations with celebrities, such as Isaac Mizrahi and, most recently, Victoria Beckham, to offer upscale clothing lines.

- Investing in Innovations: Target partnered with Amazon to develop its original e-commerce business and has built successful mobile apps to help drive sales. The company also works with technology innovators to develop projects such as Target Open House, a store consumers can visit to test smart home products before buying.

- Successful Target-Only Brands: About one-third of Target’s 2016 sales came from its own product lines and brands offered exclusively through Target stores by companies such as Levi’s, OshKosh and Carter’s.

Weaknesses:

- Price Image: Target’s upscale image limits its appeal to a relatively uniform customer base. A more expensive price reputation creates obstacles to attracting a varied audience.

- Wide Variety of Products: Target’s sales are spread almost evenly across five broad product categories, which could hinder the company’s ability to develop a focused strategy for improving sales. Its product mix includes a wide variety of departments, such as children’s clothing, groceries and sporting goods.

- Recovery Mode: Target’s recent renewed focus on its U.S. business, which has seen declining sales, has involved rapid staff cutsand an abrupt, expensive exit from Canada. The company also lost money due to a 2013 data breach that exposed payment information from tens of millions of customers.

- New Store Formats: Target is investing in opening small stores in urban markets, but the smaller format is unproven and could be costly due to high overhead expenses in urban areas.

- E-Commerce Sales: Target has touted its growing online and mobile sales, but e-commerce contributes less than 5 percent of its overall sales.

- Investing in Innovations: Target has spent money developing futuristic tech projects it has had to scrap. That may be financially draining.

- Limited Reach: Target is not an international company. Target Canada, its one retail venture outside of the U.S., was never profitable.

Opportunities:

- Positive Image: Maintaining its philanthropic efforts and becoming a leader in areas such as gender-neutral bathrooms and fitting rooms give Target a mostly positive reputation as a socially conscious company.

- Winning With Innovation: Target’s early partnership with Amazon to develop its e-commerce store positions the company as an innovator online.

- Small Stores: If Target can make small store formats work, then the company will have the opportunity to expand into upscale urban communities with dense populations and high incomes. Small stores extend the retailer’s reach into areas where Super Targets won’t fit.

- Strategic Partnerships: Enhancing partnerships with other respected companies, such as CVS and Starbucks, allows Target to focus on growing its primary retail business while also making its stores destinations for more than general merchandise shopping.

- Celebrity Excitement: Target has generated excitement among shoppers with unique fashion lines developed by celebrity designers. The company has the opportunity to continue building on its track record of forging relationships with famous personalities.

- A Changing Retail Landscape: The shuttering of J.C. Penney, Sears, Kmart and other competitor locations provides opportunities for Target to continue improving the customer experience at its stores. Target could appeal to more shoppers and fill holes opening in the retail marketplace.

Threats:

- Competitive Powerhouses: Amazon and Walmart are massive, with extensive supply chains, efficient sourcing and reputations for selling nearly every product imaginable at the lowest prices. Amazon’s growth and convenience make many products difficult for traditional retailers to sell.

- Shop-Local Initiatives: Growing consumer interest in supporting locally owned businesses could weaken the appeal of the publicly traded big box.

- Data Breaches: Target’s 2013 data breach burned customers, and more breaches could weaken the retailer’s relationship with shoppers and incur high legal costs. Large companies continue to appeal to hackers.

- Political Controversy: Taking political stances on issues such as transgender rights inspires shopper boycotts, which could harm sales.

- High Overhead Costs: Target’s forays into expensive, high-rent urban markets with small stores may backfire if the stores don’t quickly become profitable.

- Rapid Changes: Extensive changes within Target, such as employee layoffs, discarded tech projects and sold businesses, could prove to be symptoms of company instability if they don’t result in sales growth.

- The Economy: If the economy becomes more sluggish or appears unstable, then customers could react by cutting their spending and turning to retailers with reputations for lower prices.

The Financials

Expert Perspective: Target’s Future

Hardware Retailing (HR): Target says about 57 percent of its customer base have college degrees and the median income is around $64,000. Why do you think the Target brand resonates so well with these consumers?

Brian Yarbrough (BY): Target has cleaner stores, nicer stores. But the thing that really drives that is housewares, apparel, kids and baby. They know their customers well. For a few years, they were lost before Brian Cornell came in. They were trying to push food, which became stale, and they lost cheap, fast fashion, which they’ve done a good job with recently.

HR: How can Target make its small-format stores successful?

BY: I’m not 100 percent convinced they will be. When Walmart first opened small-format stores, they got to about 100 locations and it got more difficult.

Target has some good ideas with college towns, and entering into urban markets makes sense, but

I don’t know from a distribution standpoint. You’re used to having a full truck to fill a regular Target store, but the express stores are much smaller. Six or seven small stores equal one traditional store.

HR: What are Target’s growth opportunities and what obstacles exist?

BY: Honestly, I don’t know that there’s a lot of opportunity for growth. They’re pretty saturated.

I think they’re going to have to close stores.

The bigger issue is, how do you keep your current market share? They need to fix their current box before they think about growing, and online competition will make it difficult. It’s not the same profit margins, so how does Target keep its margins from serially declining? Where they can capture some market share is in their niche offerings.

HR: What are Target’s strengths in home improvement, sporting goods, home decor and automotive products?

BY: Home decor has been a great category for them because it’s fashionable stuff that’s cheaper and looks like a Pottery Barn knockoff. It’s probably their strongest category overall. They’ve done a great job with reasonable pricing and good quality that fits current trends.

Sporting goods, auto and home improvement haven’t expanded because they’re not really known for those categories. Target is not a destination for those items.

HR: What challenges does Target have when competing against Amazon, Walmart and other similar retailers?

BY: I just don’t think they can compete on pricing.

There isn’t really any other sizable online retailer that matters more than Amazon, and Target is doing a solid job of being an omnichannel retailer. When you look at price, they’re more expensive. But being brick and mortar allows them to offer options like buy online, pick up in store and returns of online purchases in the store.

To really compete, Target needs to drive people into its stores by differentiating and focusing on housewares and apparel with exclusive and private-label products.

HR: What effect did closing Target Canada have on the company?

BY: Financially, leaving Canada was a positive thing for Target because it was bleeding money.

As far as public perception, there were a lot of people who were really angry in Canada. The stores and the supply chain were a disaster. The entire expansion damaged their brand up there.

They tried to do too much, too fast. Their biggest mistake was training Canadian employees on one inventory system, and then it was a different system once they opened. They said they were fixing it, and they claimed it was fixed, but it wasn’t. Consumers continually came in the stores and found empty shelves. You’ll never get them back.

I think the Target board would hesitate about going international because of what happened there in Canada.

HR: What are Target’s biggest weaknesses?

BY: Grocery has really held them back. Fresh food is a totally different model than boxed and dry food, and Target never mastered that. They’re between a rock and a hard place in the food business because there is so much competition from grocery stores and other retailers.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information